Grow Smarter With Better Bookkeeping

Get quick, helpful bookkeeping tips or explore how professional support can free up your time to grow your business.

Struggling With Cash Flow? Your Bookkeeping May Be to Blame

Why Do Small Businesses Struggle With Cash Flow?Is My Bookkeeping Causing My…

How to Reconcile PayPal and Stripe Transactions Like a Pro

Why Payment Processor Reconciliation MattersWhat Is Reconciliation?How PayPal and Stripe Handle PayoutsHow…

Bookkeeping Basics for Small Businesses Why It Matters + How to Get It Right

Bookkeeping basics for small businessesDo I need Bookkeeping for my business?Key Tasks…

Why Mixing Business and Personal Transactions Can Hurt Your Small Business

Why Small Business Owners Mix Finances?What Happens When You Don’t Separate Business…

Why North American Small Businesses Should Use Managed Bookkeeping Services

📊 Small Business Survival by the Numbers (U.S. & Canada)Why Small Businesses…

Struggling With Cash Flow? Your Bookkeeping May Be to Blame

Why Do Small Businesses Struggle With Cash Flow?Is My Bookkeeping Causing My…

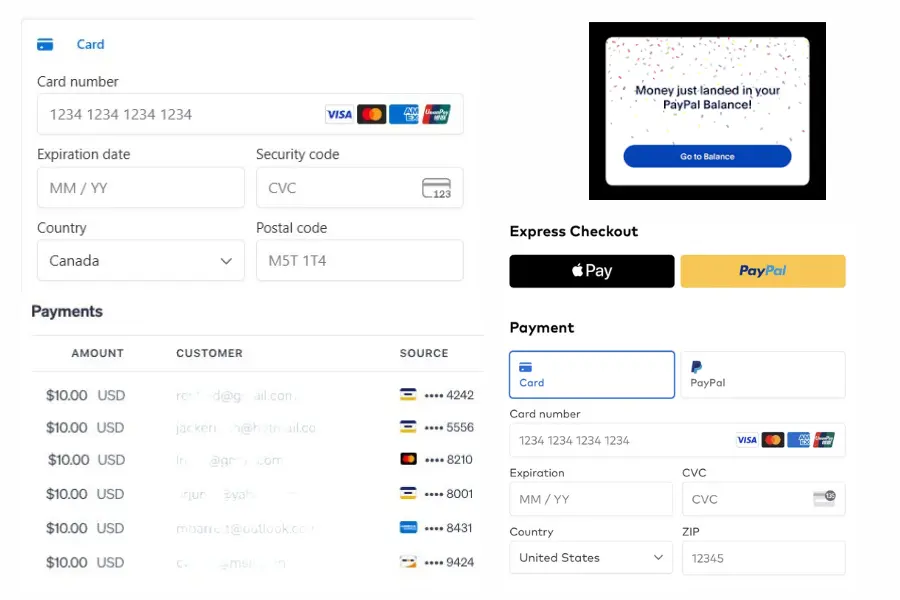

How to Reconcile PayPal and Stripe Transactions Like a Pro

Why Payment Processor Reconciliation MattersWhat Is Reconciliation?How PayPal and Stripe Handle PayoutsHow…

Bookkeeping Basics for Small Businesses Why It Matters + How to Get It Right

Bookkeeping basics for small businessesDo I need Bookkeeping for my business?Key Tasks…

Struggling With Cash Flow? Your Bookkeeping May Be to Blame

Why Do Small Businesses Struggle With Cash Flow?Is My Bookkeeping Causing My…

How to Reconcile PayPal and Stripe Transactions Like a Pro

Why Payment Processor Reconciliation MattersWhat Is Reconciliation?How PayPal and Stripe Handle PayoutsHow…

Bookkeeping Basics for Small Businesses Why It Matters + How to Get It Right

Bookkeeping basics for small businessesDo I need Bookkeeping for my business?Key Tasks…

Struggling With Cash Flow? Your Bookkeeping May Be to Blame

Why Do Small Businesses Struggle With Cash Flow?Is My Bookkeeping Causing My…

How to Reconcile PayPal and Stripe Transactions Like a Pro

Why Payment Processor Reconciliation MattersWhat Is Reconciliation?How PayPal and Stripe Handle PayoutsHow…

Bookkeeping Basics for Small Businesses Why It Matters + How to Get It Right

Bookkeeping basics for small businessesDo I need Bookkeeping for my business?Key Tasks…

FREQUENTLY ASKED QUESTIONS

Have more questions on bookkeeping or need specific help with your books?

Feel free to email us at info@sumwisehq.com

What does Sumwise do?

We help small businesses keep their books organized, accurate, and up to date. That means tracking income, expenses, sales tax, and giving you clear monthly reports.

Who is this service for?

We work with solo entrepreneurs, freelancers, and small businesses across many industries.

Examples of our business partners include : E-Commerce, Real-estate agents, Contractors (Home Repairs, Solar, HVAC, Construction, etc), Consulting, Advertising, Private Practice, SaaS

What do I need to get started?

In order to get started, you will need to provide us with your business statements, including bank and credit card statements, and any platforms you use like Stripe or Shopify. We’ll guide you step-by-step.

Do I need to know anything about bookkeeping?

Nope! That’s what we’re here for. We handle the numbers so you can focus on running and growing your business.

What results can I expect?

Clean, up-to-date books each month, so you always know where your business stands. No more guessing at tax time or stressing over receipts.

With Sumwise, you’ll have more time, better reports, and peace of mind knowing your numbers are right.

Is my financial data safe with you?

Yes. We use secure, encrypted systems to protect your data. Your privacy and trust are top priorities.

How much does it cost?

Our prices are flexible. We have plans starting as low as $79 USD ($99 CAD) for small businesses that are just getting started. As your business grows, you can move to a plan that fits your needs. There are no hidden fees or long-term contracts.

Can I sign up for multiple months to get caught up?

Yes, you can! If you’re behind on your books, we can help you get caught up—whether it’s a few months or over a year.

We’ll work through it step-by-step and make sure everything is clean, organized, and ready for tax time or financial planning. You don’t have to do it alone.

Ready to get started?

Get your books managed by professionals for better peace of mind and to free more time to focus on what you do best!

Schedule your free consultation call with us today!