How to Reconcile PayPal and Stripe Transactions Like a Pro

Payment processors such as PayPal and Stripe make getting paid easy! However, behind the scenes, your bookkeeping can get messy fast. This post provides you with a step by step reconciling guide on how to reconcile Paypal and Stripe transactions properly, whether you’re on cash or accrual accounting, and why it matters for your small business.

Why Payment Processor Reconciliation Matters

Stripe and PayPal don’t just deposit your sales straight into your bank. They take their cut first, hold funds, delay payouts, and combine multiple transactions into one lump sum. That creates confusion for small business owners trying to match income to bank deposits. Often times, small business owners express frustration at the fact that their Stripe dashboard is saying they have lots of sales in the month, but their bank account does not match their expected balance.

If you skip reconciliation:

According to Intuit:

40% of ecommerce bookkeeping errors are caused by third-party payment processors. That’s a lot of missed money!

What Is Reconciliation?

Reconciliation is the process of matching what’s in your financial and bookkeeping system to what actually happened in your business and your business account in the real world.

When it comes to PayPal or Stripe, that means:

How PayPal and Stripe Handle Payouts

Here’s how it typically works:

- Customer pays you via PayPal or Stripe

- Stripe/PayPal collects the gross sale

- They deduct fees (usually 2.9% + 30¢ or more)

- They hold the funds for 1–3 days (*With PayPal, the funds may be held in the Paypal account to be used as cash to pay other business expenses via Paypal)

- Then, they send a net deposit to your bank

So what hits your bank isn’t the full sale. Rather, it’s what’s left after deductions.

If the Paypal account is not reconciled as a transit account, business expenses paid via Paypal can be lost, resulting in missed deductions!

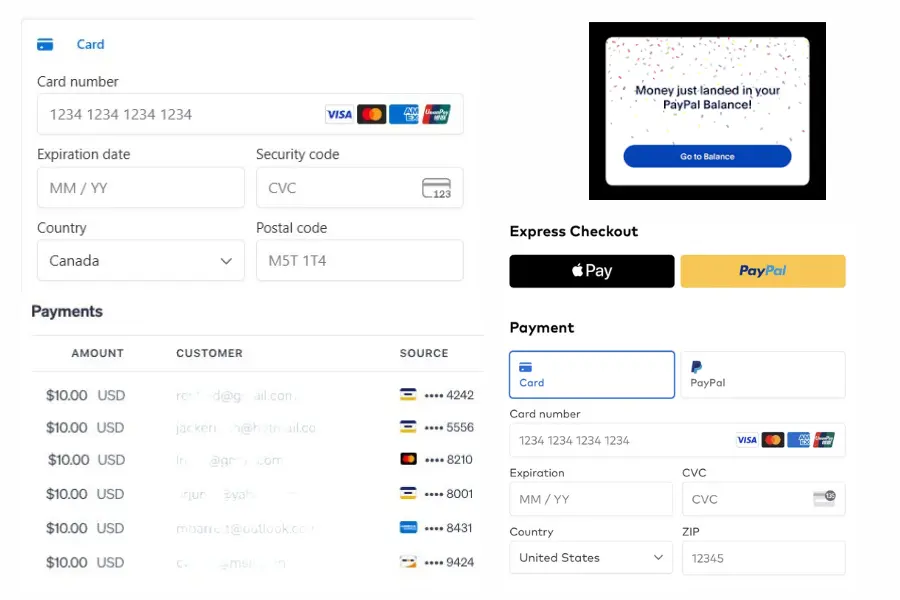

How to reconcile Paypal and Stripe Step by Step

Follow this simple 5-step reconciling guide you can follow to reconcile your Paypal and Stripe transactions for your business:

1. Download Payout Reports

- Stripe: Go to Payouts > Export in your dashboard

- PayPal: Go to Activity > All Transactions > Export CSV

💡 Tip: Make sure you select the proper date ranges so your report matches the periods you’re reconciling in your books.

2. Group Transactions by Payout

Match each deposit in your bank account to a Stripe or PayPal payout report.

3. Break Down the Deposit

Each payout could be a combination of the following:

- Gross sales

- Refunds

- Processor fees (also known as merchant account fees)

- Net deposit

4. Post to Your Books

Record each payout as one line item with the breakdown categorized properly:

- Sales = income

- Fees = expense

- Refunds = contra-income or expense

5. Reconcile Bank and Clearing Accounts

Match net deposits to bank feed. If you’re using accrual accounting, use a clearing account for Stripe/PayPal activity (more below).

Important questions to ask yourself as you’re reconciling your payment processor account are:

- Do I have all payouts that are showing on my payout report in my bank account?

- If the payout amounts are not matching, could there be additional fees that Stripe or Paypal is charging me?

- Do I have any refunds or chargebacks that I will need to adjust for in this period?

- What balance, if any, do I have with the payment processor at the end of the reconciliation period? Do I need to take any action to transfer funds to or from the processor?

Cash vs Accrual: How It Changes Stripe & PayPal Reconciliation

Before you start reconciling, know your accounting method. Here’s why it matters:

📊 Reconciliation Cheat Sheet

| Cash Basis | Accrual Basis | |

|---|---|---|

| Revenue is recognized when: | You receive the payout in your bank account | The customer pays (even if the payout comes later) |

| Focus of reconciliation: | Bank deposits | Processor activity (use a clearing account to record all revenue, fees, transfers) |

| Fees and refunds: | Only recorded when they hit your bank | Recorded when incurred (usually upon payment completion by client) |

| Complexity | Simpler | More accurate, but involves more work |

| Pro tip | Reconcile based on payouts, not orders | Reconcile the clearing account at regular intervals |

💡 Tip: Accrual basis is more accurate for fast-growing businesses or anyone selling high volume or digital goods. If you want accurate insights of how much your business is truly making month over month, the accrual basis is the preferred method.

How Bookkeeping Software Helps

Modern tools like QuickBooks Online, Xero, and Wave can sync directly with Stripe and PayPal.

You can easily create a transit or clearing account for your Stripe or Paypal accounts to add your transactions and reconcile them like a pro on any of these platforms!

Key benefits of syncing your Paypal or Stripe directly to your bookkeeping software:

- Auto-imports daily transactions

- Can auto-categorize sales and fees

- Allows use of clearing accounts to track money before it hits your bank

Still, setup matters. If you don’t tag the data correctly, you’ll just end up with duplicate or miscategorized income.

Sumwise Pro Tips

We use clearing accounts for all our clients using PayPal or Stripe. Here’s what it looks like:

- Stripe sales go into a Stripe Clearing account

- Paypal sales (and expenses) go into a Paypal Transit account

- Fees and refunds are recorded when they happen or via a bulk journal entry at a reasonable interval (weekly, monthly, quarterly, or annually depending on the months we’re working on.)

- When Stripe or Paypal sends a payout to your business bank account, it’s recorded as a transfer, not new income

This keeps your income accurate, especially if you offer refunds or have delayed payouts.

How can I speed Up Reconciliation?

- ✅ Reconcile weekly or bi-weekly—don’t wait months

- ✅ Flag chargebacks and holdbacks immediately

- ✅ Use naming rules to auto-tag Stripe/PayPal entries

- ✅ Match deposits as a group, not line by line

Final Thoughts

Stripe and PayPal make getting paid easy. But reconciling them? That’s where most business owners come up short. This often comes with costly consequences such as failing to take advantage of tax deductions, failing to gain helpful insights on how much money the business is actually making.

Doing it right ensures:

- Your income is accurate

- You don’t miss hidden fees or refunds

- You stay tax-ready and audit-proof

If reconciliation is draining your time—or you’re just not confident in your setup. Sumwise can handle it all for you. See how small businesses can set themselves appart from the competition with managed bookkeeping services such as Sumwise!

📥 Free Stripe & PayPal Reconciliation Checklist

Want a printable checklist you can follow every month?

Send us a message at info@sumwisehq.com to get your free checklist within 24 hours!

💬 Ready to Get Your Books in Order?

Let Sumwise reconcile your PayPal and Stripe the right way—so you can focus on selling, not sorting through spreadsheets.